tax saving strategies for high income earners canada

If you are an employee and you have an employer-sponsored 401k or 403b in 2018 you can contribute up to 18500 per year of your gross income. Here are a couple of tax planning strategies that will be highly effective for you.

Pin By Niina Felushko On Financial Matters Senior Discounts Efile Tax Return

Employer-based accounts such as 401 k and 403 b accounts allow you.

. Some of the legally permitted ways of splitting income as per the current regulations include. Since AEF is a public charity contributions immediately qualify for maximum income tax benefits. There are also a lot of tax credits available which reduce your tax liability dollar for dollar.

The more money you make the more taxes you pay. Tax-Saving Tips For Canadian Taxpayers. Take advantage of vehicles for future tax-free income.

You will be saving your hard earned cash from going to the Canada Revenue Agency. When withdrawals are made and your child signs up for a post-secondary education program the income earned in the plan will be taxed at a lower rate than your own. To prevent passive investment income unrelated to the active nature of the business from being unduly spared from taxation the CRA has put a policy in place that will see the 500000 SBD threshold rolled back by 5 for every 1 of passive income earned inside the corporation in excess of 50000 per annum thereby exposing more business income to higher.

One of best ways for high earners to save on taxes is to establish and fund retirement accounts. All the investment income in the TFSA grows tax-free and future withdrawals are not taxable. If you live or earn income in Canada you will have to pay income tax.

Nevertheless many high-income Canadians dont take advantage of this opportunity. Two a spousal loan strategy which enables your lower income spouse to earn investment income at their lower tax rate. So if possible we recommend you wait and leverage this tax rate difference to make tax savings.

With your qualified tax advisor. Splitting income within a family unit is an effective way for high income earners in Canada to reduce their tax burden. 50 Best Ways to Reduce Taxes for High Income Earners.

Here are some of our favorite income tax reduction strategies for high earners. For higher-income earners income splitting redirecting income within a family unit can be one of the most powerful tools for families to reduce their tax burden and keep after-tax dollars in their hands versus more of their income going to the Canada Revenue Agency. Max Out Your Retirement Contributions.

One a family trust which enables you to provide funds for your children or grandchildrens needs while reducing taxes. These 12 tax saving strategies above are far from the be all end all when it comes to tax savings. Tax deductions are expenses that can be deducted from your taxable income and therefore your tax liability.

Do you earn a lot of money. Making simple mistakes on your income taxes the optimization of your investment accounts or the inopportune sales of capital property can just end up in more of your hard earned money being in the governments hands. Lift current caps on deductions for state local and real estate property taxes.

The more money you make the more taxes you pay. Fortunately there are many ways high earners can reduce the taxes on their income. Lets start with retirement accounts.

Return the corporate tax rate to 28 percent from the current 21 percent. Here are 50 tax strategies that can be employed to reduce taxes for high income earners. 9 Ways for High Earners to Reduce Taxable Income 2022 1.

For the nations highest-income earners those making more than 220000 annually the amount going to the tax man is. Here are five tax saving tips that are easy to apply. Tax-Free Savings Account TFSA In addition to investing in a TFSA of your own consider making a gift to your adult family members or spouse to enable them to contribute to a TFSA.

Sell Inherited Real Estate. One of best ways for high earners to save on. Leverage Home Sales Tax.

You receive an immediate income tax deduction in the year you contribute to your DAF. One can avail of this benefit provided you are married file a joint tax return and the. You can deduct the amount you.

There are four initial ways that high income earners could benefit from using a donor advised fund DAF to lessen their tax burden. Eliminate the 20 percent long-term capital gains tax rate and replace it with the 396 percent ordinary income tax rate for individuals whose adjusted gross income exceeds 1 million. Heres some other ways to reduce tax.

But with big money can come big taxes. Taking advantage of all of your allowable tax deductions and credits. Further there will generally be no income.

The math is simple. Income splitting with family members is a simple and effective tax planning strategy. If you are a high-income earner who is planning to sell your primary residence then you may further save on your tax on up to 500k of your capital gains.

Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income exceeds a set amount. Income splitting opportunities permitted under current legislation include but arent. The contribution you will make will come straight out of your.

Tfsa Vs Rrsp How To Choose Between The Two 2022 Canadian Money Retirement Advice Finance Blog

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

52 Week Money Challenge For Incomes Under 25000 A Year Etsy Money Challenge 52 Week Money Challenge Money Saving Strategies

How Is Unemployment Taxed Forbes Advisor Forbes Advisor

Pin On Advanced Financial Planning

![]()

Pin By Niina Felushko On Financial Matters Senior Discounts Efile Tax Return

Pin By Niina Felushko On Financial Matters Senior Discounts Efile Tax Return

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

8 Ways To Help Lower Clients Taxes And Boost Their Retirement Savings Advisor S Edge

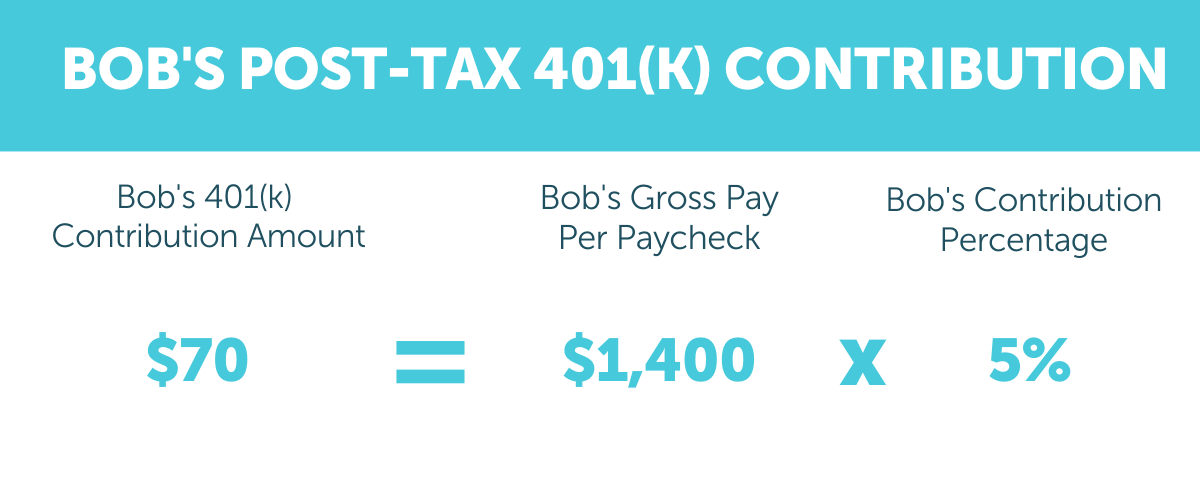

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

What Are Real Assets And How To Diversify Your Wealth By Investing In Them Investing Diversify Business Management

2022 Tax Inflation Adjustments Released By Irs

Pin By Niina Felushko On Financial Matters Senior Discounts Efile Tax Return

Do Physicians Have It Worse Than Other Professions When It Comes Down To Job Satisfaction Truth Is Most Jobs Suck A Lot More Job Satisfaction Job Job Wishes

Dividend Tax Rates In 2021 And 2022 The Motley Fool

How The Streamlined Tax Amnesty Program Work Expat Us Tax

Tfsa Vs Rrsp How To Choose Between The Two 2022 Canadian Money Personal Finance Blogs Personal Finance